Custom assets aim to consider any investments that are not traded on the stock market or are not supported within the Snowball Analytics service.

If assets have constant income in the form of accruals you can adjust their number and frequency, and the service will show future payments on the dividend calendar and calculate the div yield. The current price for custom assets is set manually.

Examples of custom assets

- 🏦 Savings account

- 🏠 Real estate

- 🤝 P2P loans

- 💶 Any other custom investments

How to add a new asset?

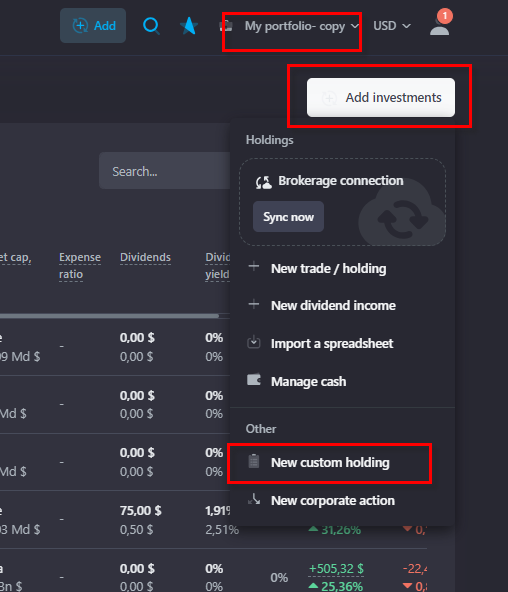

- Select an individual portfolio (You cannot add assets to a composite portfolio).

- Go to the Portfolio → Holdings page and click on the Add Custom Asset.

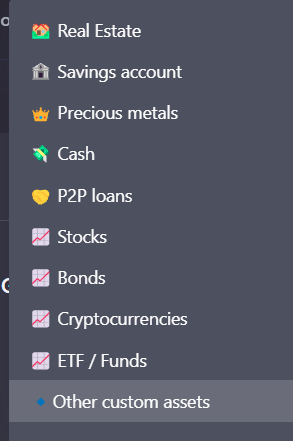

3. Select asset type. If you don't see a suitable option, you can leave the "Other custom assets" type. The selected type does not affect the set up of a custom asset (except for the Savings account type), it can only affect which sector or asset class it belongs to.

4. Fill in the required fields.

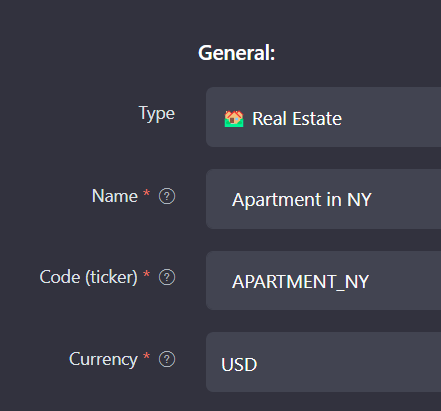

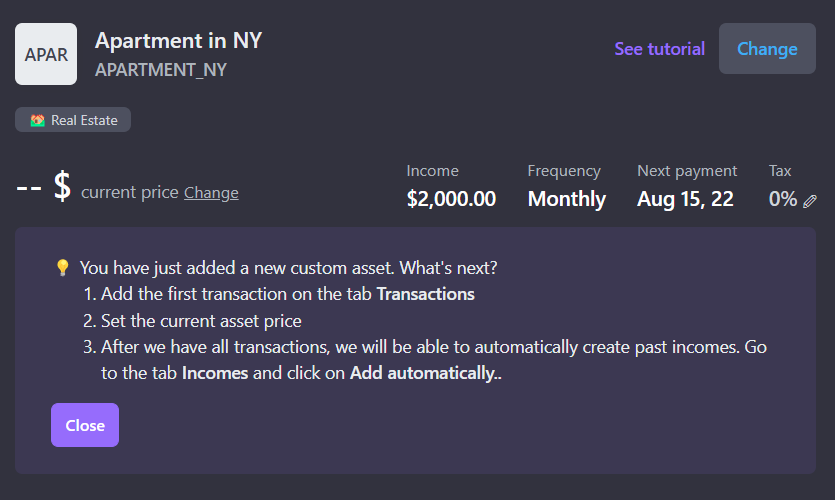

To clarify the idea, let's create a Real estate asset - an apartment in NY.

General Info

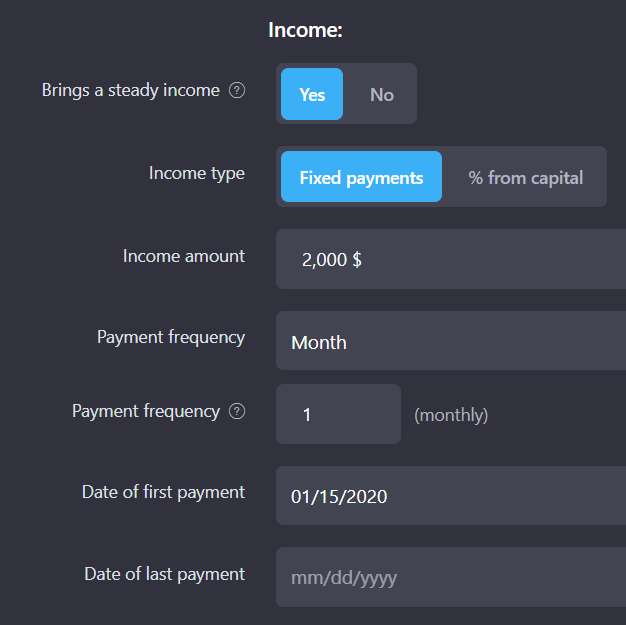

Income

We indicated that the monthly incomes would be $2,000. Let’s assume we received the first payment on January 15, 2020 and we receive monthly rent.

After the parameters are configured, you will be redirected to the page of the custom asset so that you can add transactions, payments and set the current price.

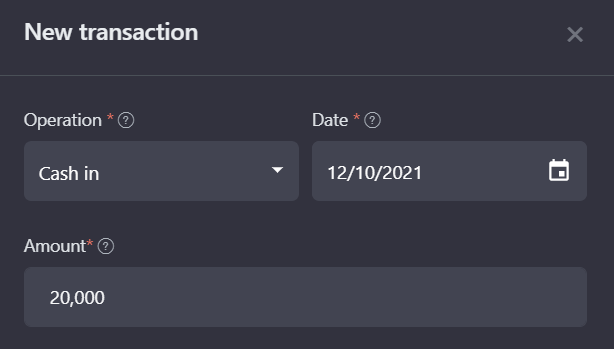

Add a purchase transaction for this apartment:

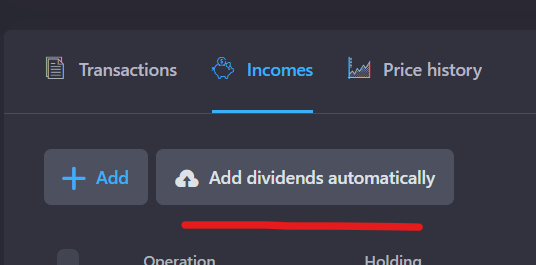

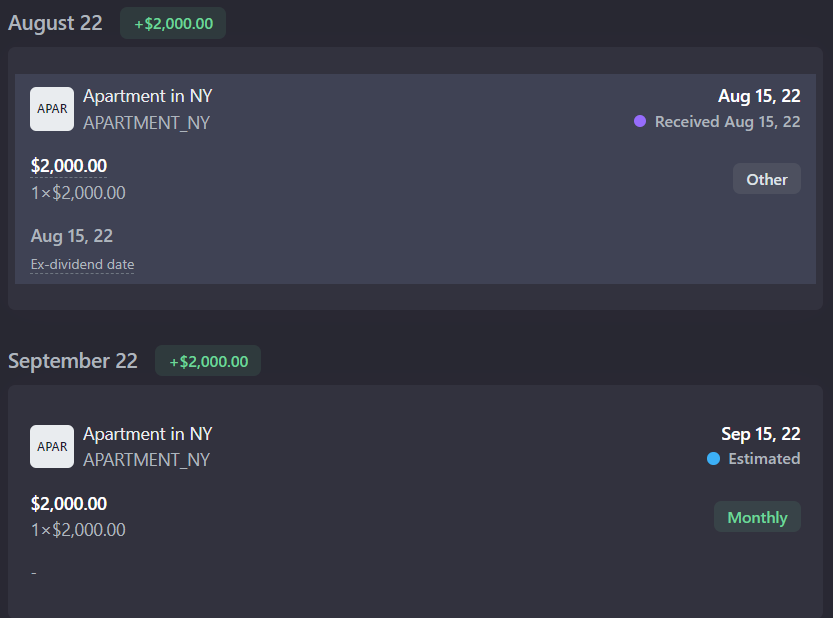

Then you will be able to generate past payouts on the Incomes tab and view projected income on the Dividend calendar.

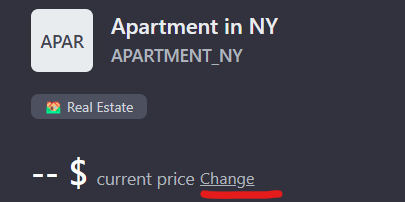

How to set the price of a custom asset?

You can set both the current price of an asset and the "historical" one - how much it used to cost in the past. To set the price, go to the page of an custom asset, click Change next to the price.

You will be able to choose the date when this price was valid. In order to calculate the current price we take the last one from the history.

Income from custom assets

If an asset is profitable and provides you with some steady income, for example, rent, interest or something else - you can set the frequency and amount of these payments in the asset settings.

Let's look at some examples:

Fixed income once a month

For an example of setting up such an asset, see section called How to add a custom asset.

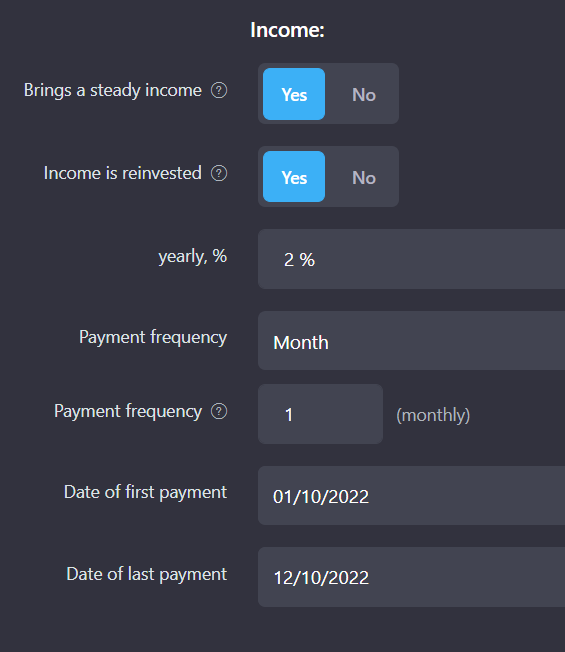

The date of the first payment is the date from which payments for this asset began.

The date of the last payment is the maturity date of an asset.

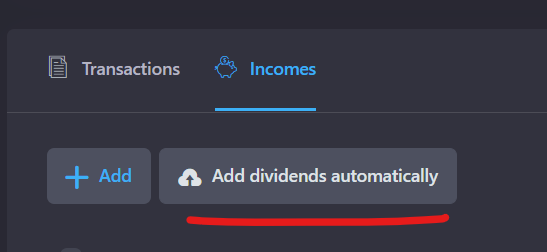

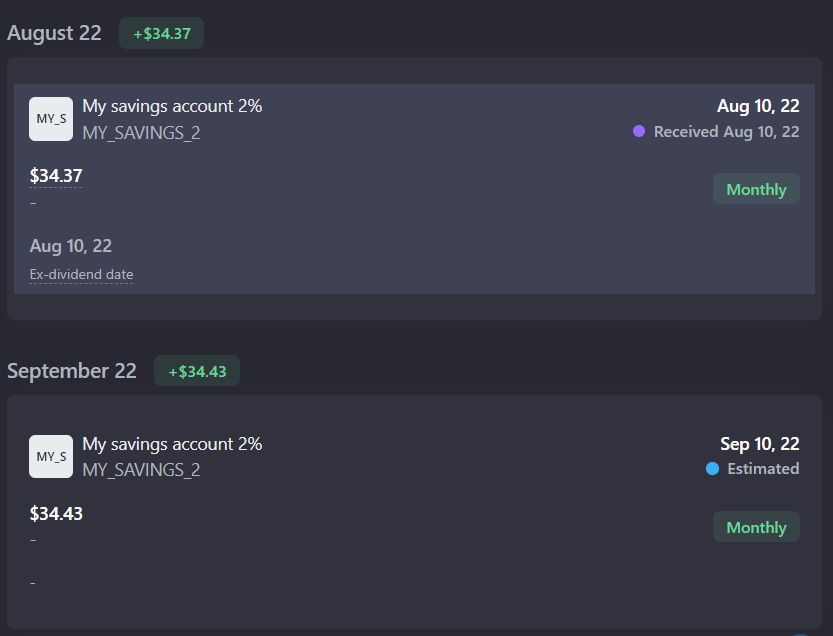

After the asset is added and configured it is possible to add past incomes through Automatic dividend calculator. Future payments will also be displayed in the dividend calendar.

Interest income

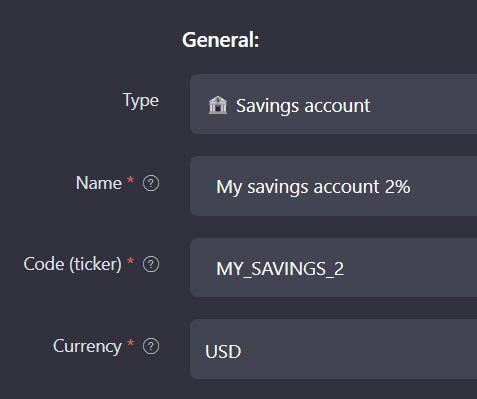

- Select "Savings account" as the asset type

2. Specify annual interest rate, payout frequency, date of the first and last payments (maturity date).

3. Add your contributions and withdrawals on the Transactions tab

4. Generate past payouts on the Incomes tab

5. You can view your estimated future income on the Dividend calendar page.

☝️Please note

- Custom assets do not participate in the calculation of Metrics on the Analytics page (Beta, Sharp, Sortino).

- Custom assets are not included in the Search for Dipped assets on the Recommendations page.

- Transactions on custom assets can be exported to CSV.

- Each custom asset is linked to the portfolio in which it was created. Such assets can be transferred between portfolios.

- A custom asset cannot be edited inside a composite portfolio.