What is a backtest?

Backtesting - is testing the behavior of an investment portfolio on historical data.

This allows investors to assess how their portfolio would have performed in the past if they had invested in it, evaluate the effectiveness of investment strategies, and identify portfolio strengths and weaknesses.

How to perform a backtest?

- You specify a combination of assets. For example, VOO 60% TLT 40%

- Specify test parameters. For example, invest 10,000 USD in January 2015, then contribute 1,000 USD every month and reinvest all the dividends received.

- Choose a benchmark - an index or index fund to compare the portfolio with.

- Analyze the portfolio behavior in the past, compare the results with the benchmark and decide whether you should invest in such a portfolio

Why do a backtest?

A portfolio backtest allows you to evaluate how a portfolio behaved in the past at various phases of the market: how much it lost during crises, whether it was more volatile or vice versa - more stable.

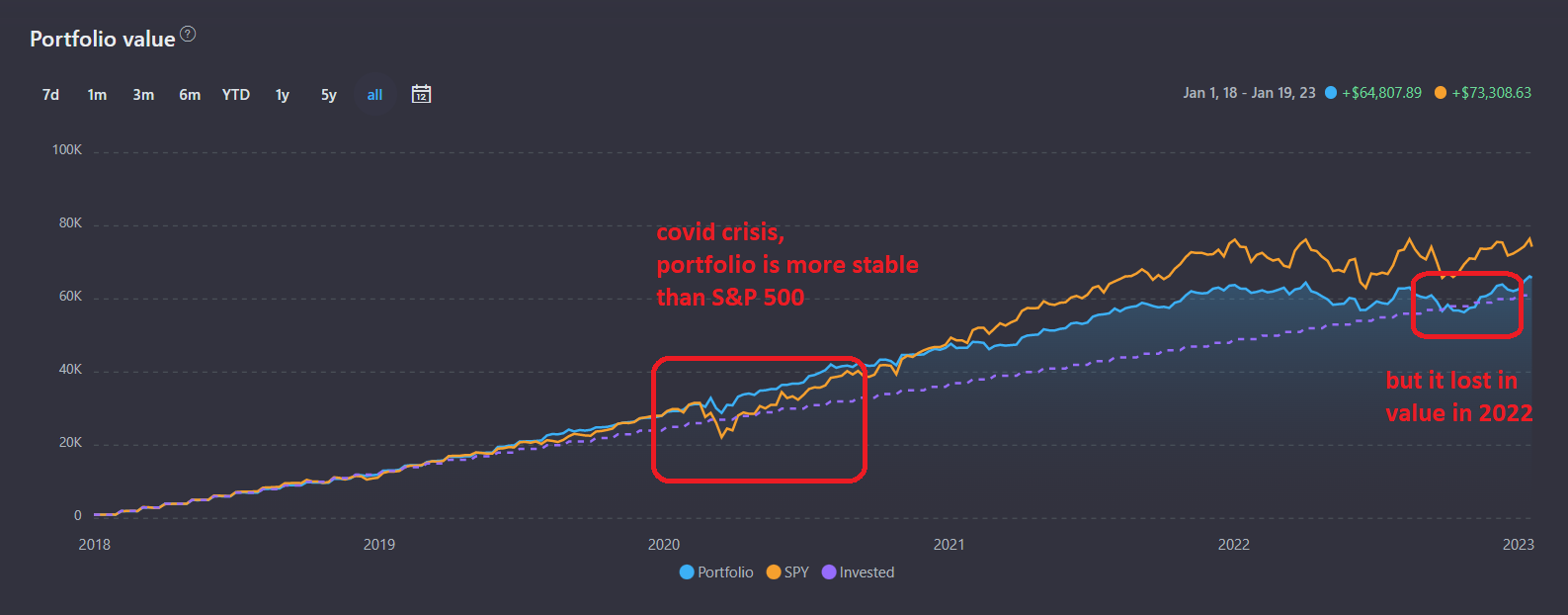

Example #1 Defensive or offensive strategy

For example, you want to build a "defensive portfolio" that are meant to protect you against significant losses from major market downturns. When conducting a backtest, you should pay attention to how this portfolio has performed in past crises.

And vice versa, if you are thinking of a more aggressive strategy, then first of all, the investment portfolio should outperform the market in terms of profitability, even with greater risks.

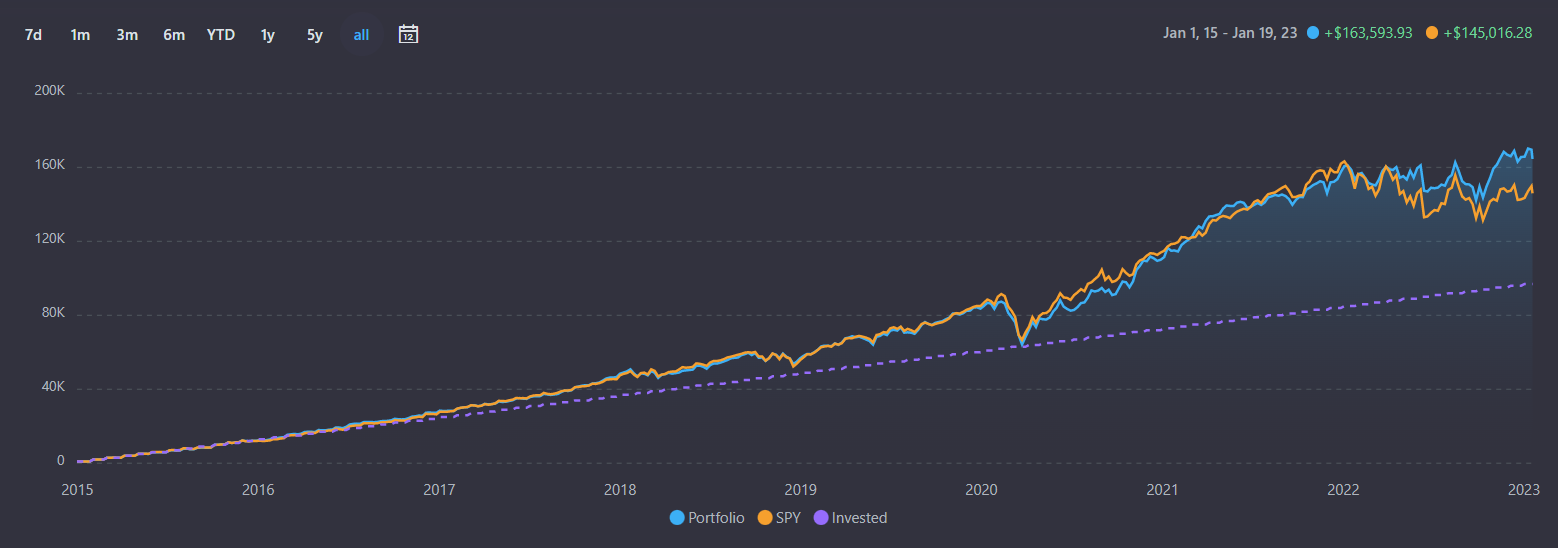

Example #2 Comparing dividend and index strategies

With the help of a backtest, you can compare the behavior of a portfolio of dividend stocks with a broad market index and decide on the appropriateness of such investments.

For example, a portfolio from a SCHD fund (a fund that invests in US dividend stocks) has comparable volatility and returns to the market. At the same time, in a bullish market, the S&P overtakes the portfolio, and vice versa in a bearish market.

How to use the results?

It is always worth remembering that a backtest is just a study of past, historical results.

The results of the backtest do not guarantee similar results in the future, but give an understanding to the investor about how his investment portfolio can behave under certain market conditions, and whether it is more effective than the strategy of investing in an index fund.

Compare portfolio performance with the market

In this case, the market benchmark is the market index fund. At this stage, the investor must make a visual comparison of the capital curve of the investment portfolio and the market index.

The most important thing is to determine whether the investment portfolio outperforms the market index in terms of profitability, and how it behaves during the fall of the stock index.

Portfolio Metrics

The second thing you need to pay attention to is the risk-return ratios of the resulting portfolio (Sharpe, Sortino).

If the coefficients of the investment portfolio are higher than the coefficients calculated for the index fund, then this indicates that the investment portfolio has better characteristics in terms of risk/return relative to the index.

In another way, we can say that such an investment portfolio brings more percent of potential return for one percent of potential risk.