Portfolio Lab 🧪 - is a place where investor can test their investment ideas, build a suitable investment portfolio and evaluate the performance and risk of a combination of assets.

You can run two types of tests in Portfolio Lab:

- Calculator 🧮 - calculate dividend income and dividend yield, check diversification and metrics of the portfolio

- Backtest 📈 - check the portfolio on historical data, compare its behavior with the benchmark

How can this help you?

Use the Portfolio Lab when building a new investment portfolio or if you want to optimize your current strategy.

What tasks does the Calculator 🧮 help solve:

- Selection of the optimal combination of div. yield and dividend growth for the Dividend Portfolio

- Building a diversified portfolio - see diversification by sector, region, currency, etc.

- Find out how much money is needed to buy the planned portfolio (if you don't have access to fractional shares)

- Selection of a combination of assets to receive dividend payouts evenly - for example, if you want to receive approximately the same amount of dividends every month

- See how your dividend income/yield will change if you swap one asset for another

What tasks does the Backtest 📈 help solve:

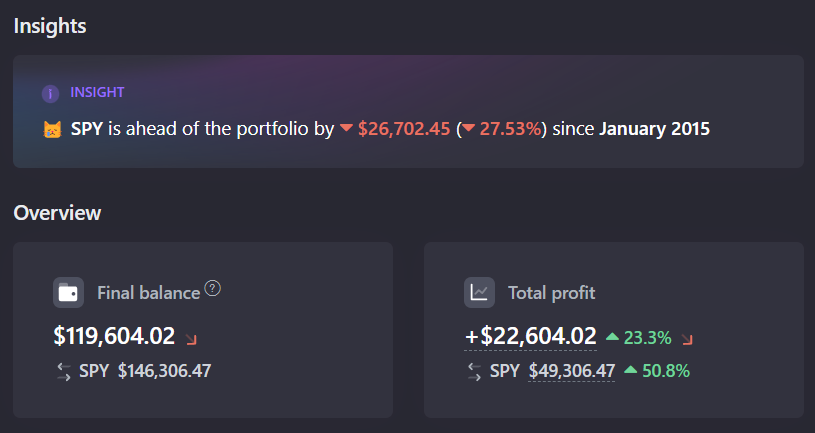

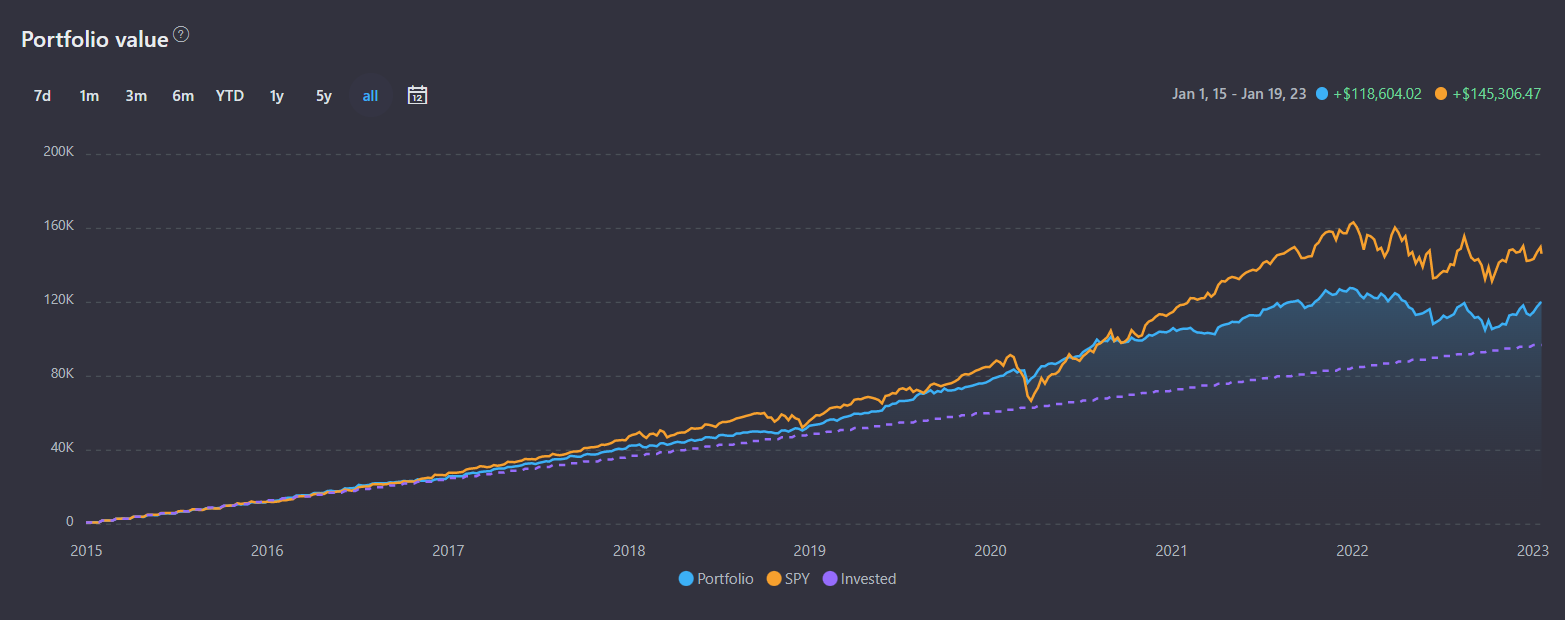

- Study how the portfolio behaves in different market conditions (for example, during a crisis) and see if it meets your expectations

- See how periodic portfolio rebalancing can affect returns and learn if it's worth it for your strategy

- Building a defensive strategy - search for an optimal combination of assets that is most stable during volatile markets

- Compare portfolio behavior with a benchmark, such as S&P 500

How it works?

- You create an investment portfolio (or copy from existing ones) and set target allocation for assets, for example:

2. Set test parameters.

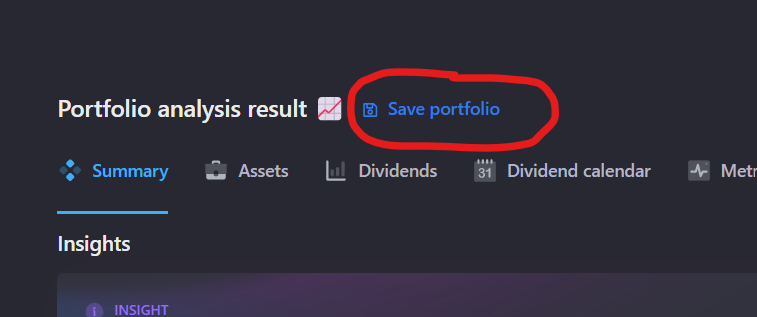

3. Check the results of the experiment.

4. If you are satisfied with the results, save target allocations of the portfolio. You can then use our Rebalancing tool to make purchases.

5. Didn't like the results? Change the composition of the assets and the assets themselves and keep experimenting!

💡

It is important to remember that past results do not guarantee future results, but give investor an idea of how their investment portfolio might perform under certain market conditions, and whether it is more effective than investing in an index fund.

Backtesting an investment portfolio: why do you need it?

What is a backtest? Backtesting - is testing the behavior of an investment portfolio on historical data. This allows investors to assess how their portfolio would have performed in the past if they had invested in it, evaluate the effectiveness of investment strategies, and identify portfolio stre…

How to: set up categories and change target allocations

If you are not familiar with the categories tool yet, we recommend you to read this article first. This article is for those who have already roughly decided on their investment strategy and want to set up categories in Snowball Analytics for their portfolio. When creating a portfolio, we set