This is an introductory article, if you would like to find out how to edit categories, you can read this article.

What are categories for?

Categories are an universal tool that helps you to:

- Have a balanced portfolio

- Make monthly purchases

- Manage multiple strategies in one portfolio

- View analytics separately for each category/group of assets and compare them with each other

What are categories?

Our service is built around diversification: creating a balanced investment portfolio from various asset classes. Categories would be the main tool to use as it makes it possible to independently divide the portfolio into categories and subcategories that may reflect asset classes, different investing strategies, or form a portfolio from one asset class which would be diversified by economic sectors, countries, currencies, etc.

Categories allow you to plan an investment portfolio - you can set an unlimited number of categories, fill them with assets and set target allocations for both categories and holdings included in them. Each category or asset in the portfolio should take up some allocation, which depends on the investment period, goals and risk profile of the investor.

To put it simply, categories are similar in idea to a computer's file system - a portfolio can be divided into folders, and holdings act as files.

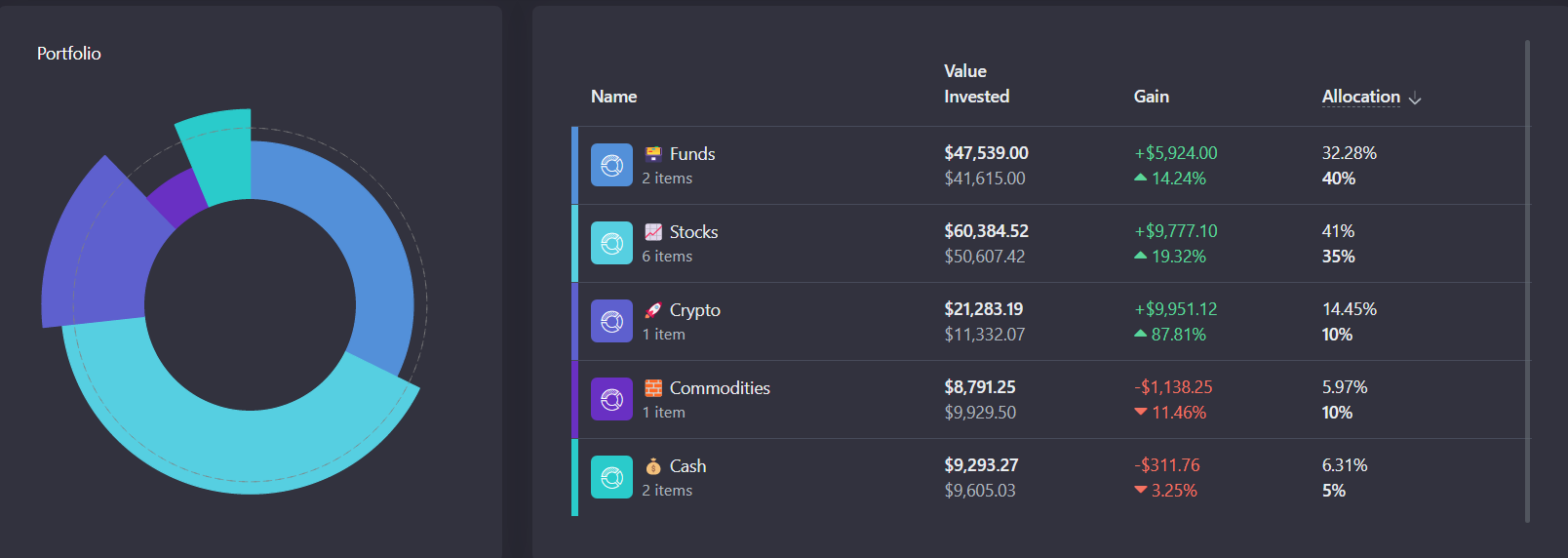

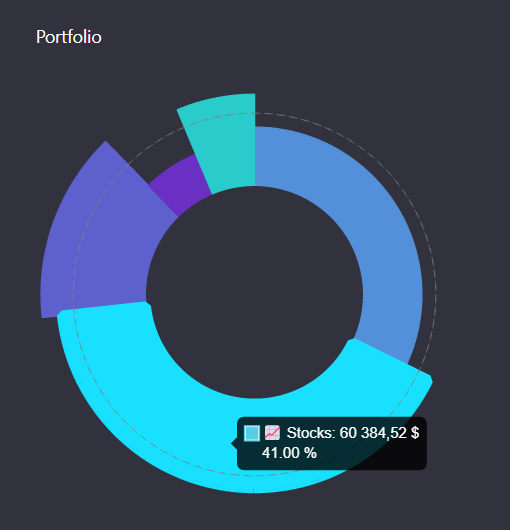

In addition to the target portfolio composition, the categories tool allows you to see the current allocation of holdings in a portfolio or a category on a pie chart:

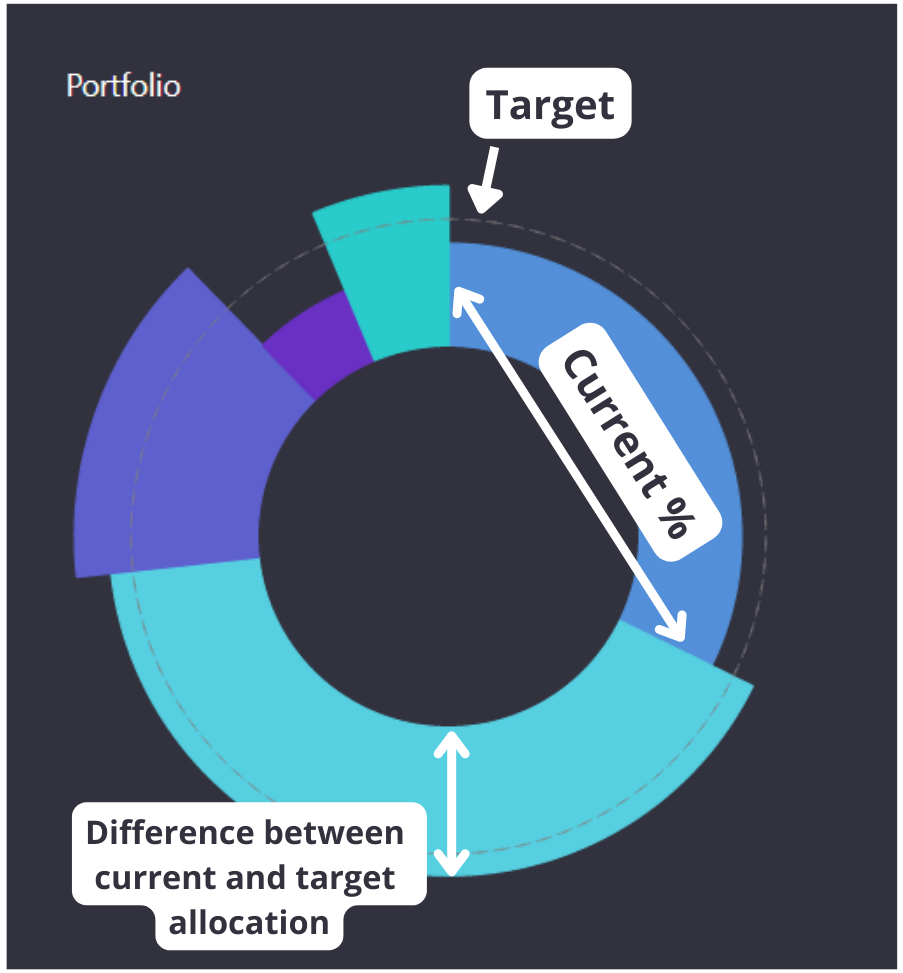

This pie is displayed for each category, its path is visible at the top. Each category or asset has its own colored sector, as well as size:

- The width of the sector shows the current share in the selected category - the wider the sector, the larger the share.

- The height of the sector shows how much the current share of the asset differs from the target - the more the height of the sector deviates from the dotted line, the more the share differs from the target.

- The dotted line shows the target share. Ideally, the sectors which correspond to the target portfolio lie on this circle.

Example

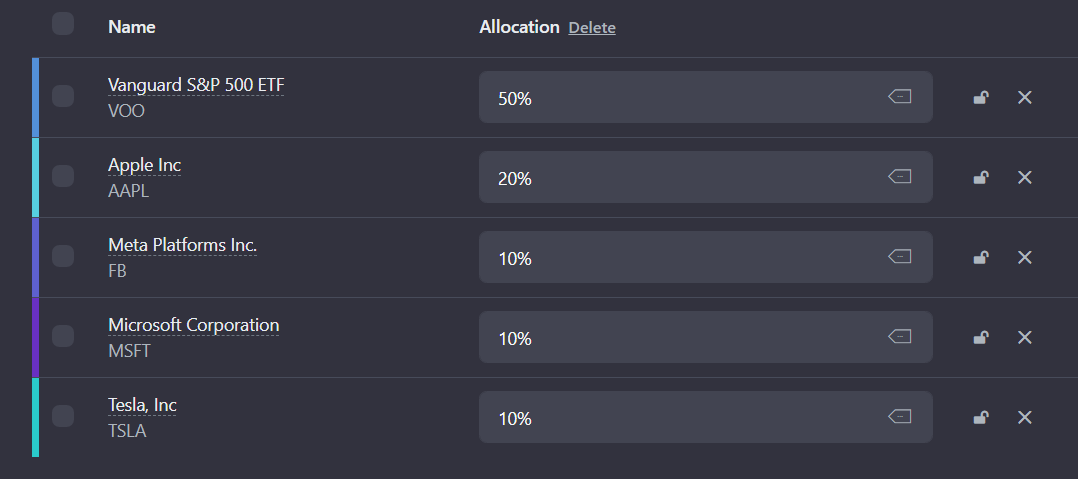

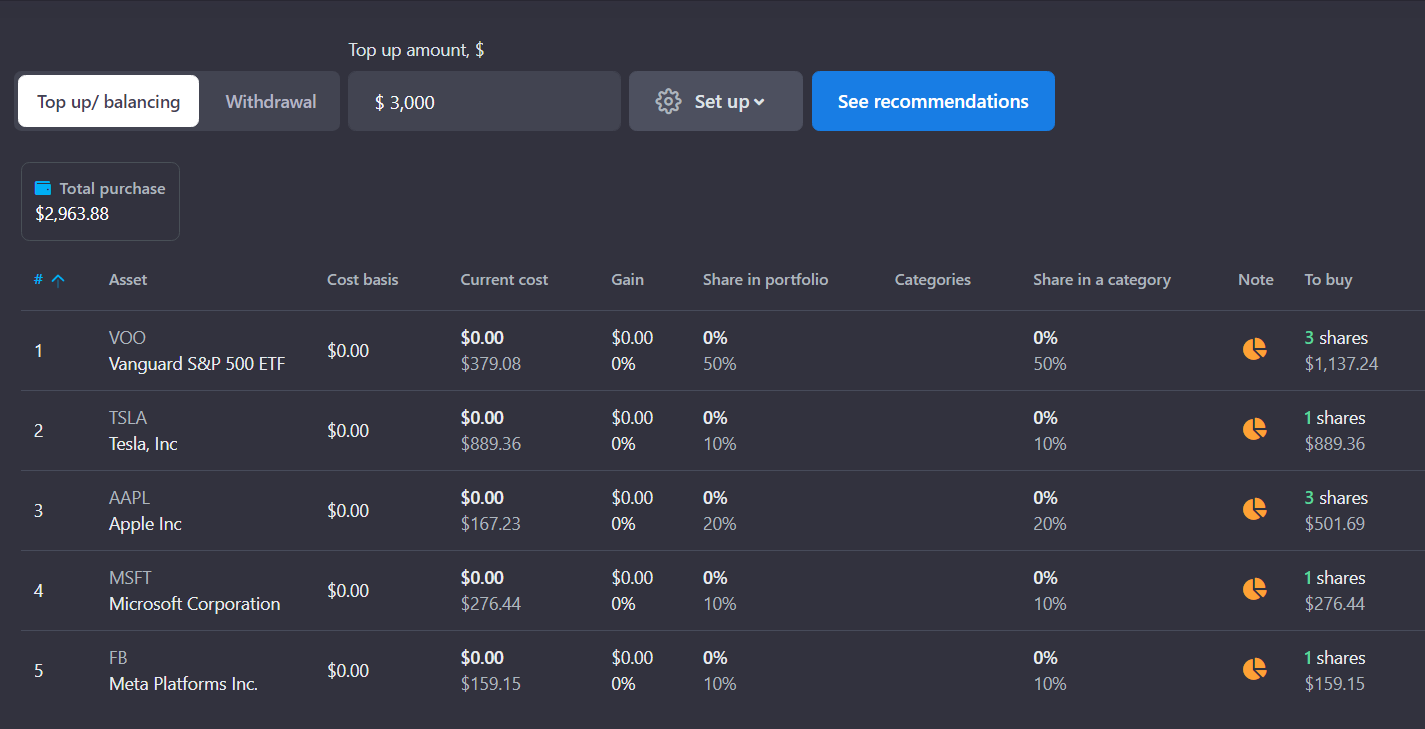

Let's take a look at an example - you are creating an investment portfolio to which you add 5 different assets: VOO, AAPL, FB, TSLA and MSFT.

At the same time, as an investor, you understand that it is not enough just to buy 1 share of each of these companies. So you have an investment plan: to allocate half of the portfolio to VOO, about a quarter to AAPL, the remaining shares should occupy equal shares of this last quarter.

Categories allow you to transfer this portfolio plan from your head to our service - you can split the portfolio into these segments and assign certain targets to the shares:

VOO- 50%

AAPL - 20%

TSLA, FB, MSFT - 10% each

Your portfolio structure is now ready. After that, with the help of Portfolio rebalancing you will easily keep the portfolio in these proportions.

This is just an example, and your portfolio can be much more complicated: it may contain different asset classes, different sectors of the economy, dozens (and sometimes hundreds of assets), but all this can be implemented and distributed using categories.

View analytics by category

With the help of categories, not only can you set the target allocations of the portfolio on the main page, but also get detailed analytics and recommendations.

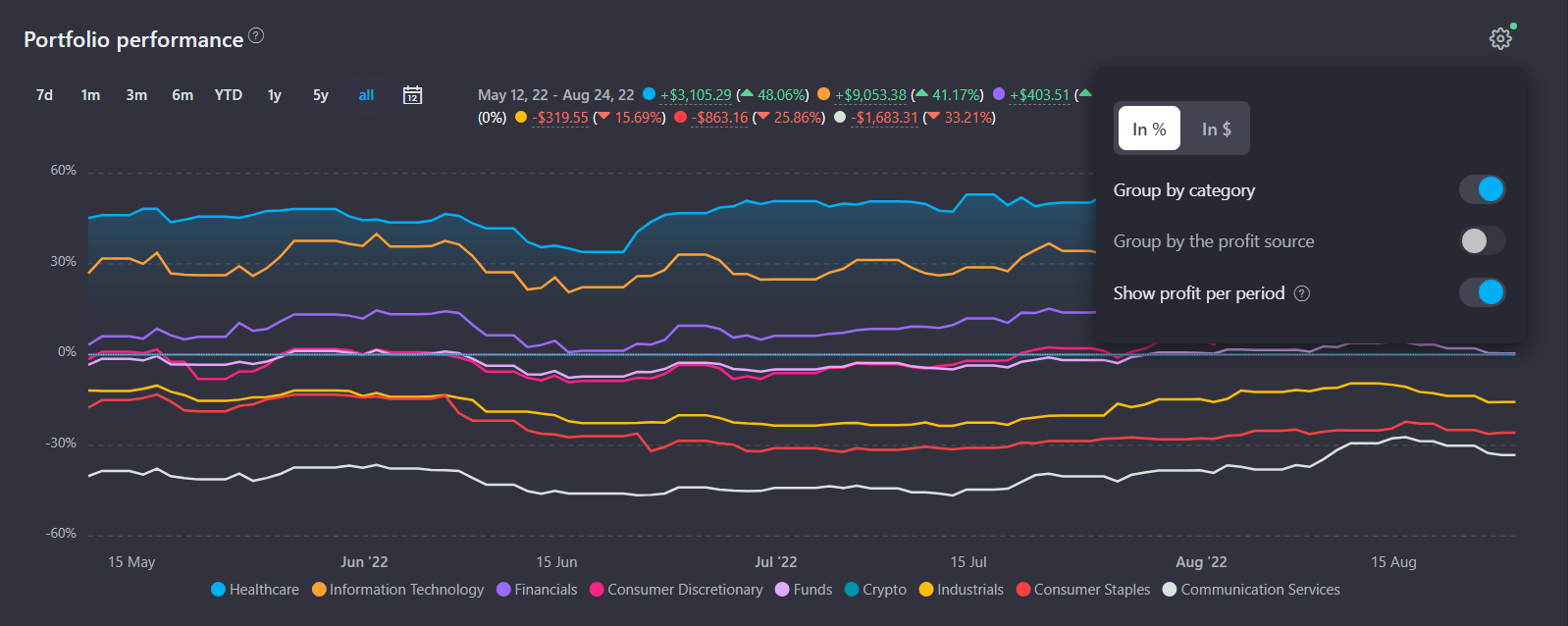

Each tab in the Analytics page contains a filter in which you can specify several categories and holdings to show the results of analytics only for selected items.

On the Analytics -> Growth tab in the chart settings, you can enable grouping by category, so that you can have a visual representation of how various assets from different categories behaved at the selected time interval.

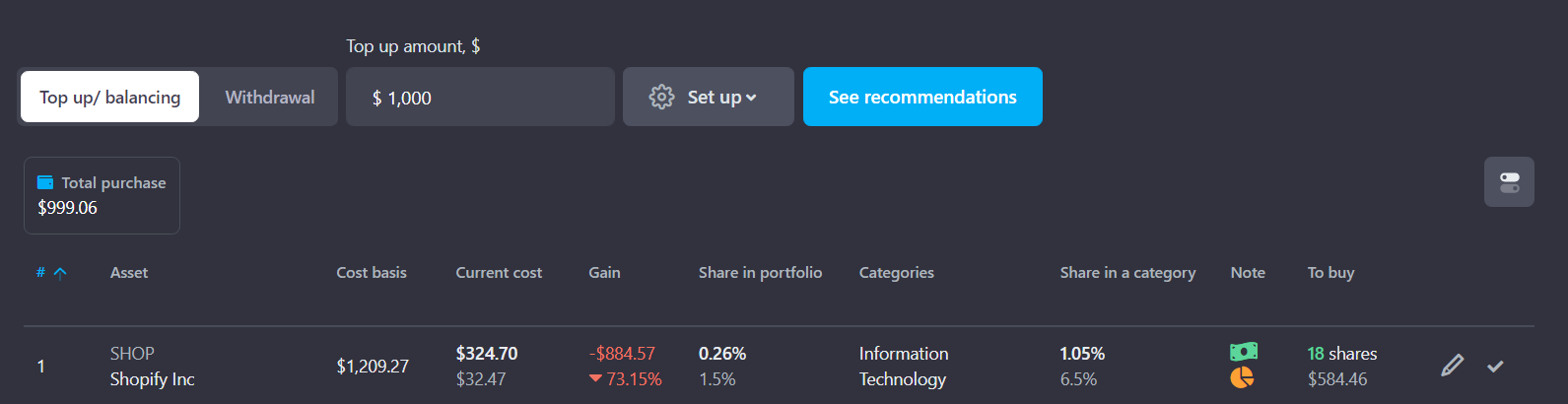

Portfolio rebalancing tool

On the Portfolio rebalancing page, there is a tool that works based on categories - depending on the settings, it recommends assets for purchase or sale in order to restore the balance of their allocations in the portfolio or a category. You can read more about it in this article.

Next