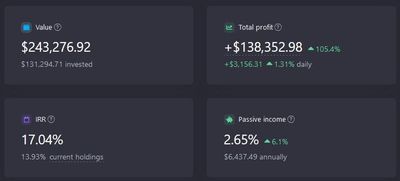

The Analytics page shows the main indicators for the portfolio:

- Value;

- Invested;

- Total profit;

- Profit for the day (daily);

- IRR;

- Current holdings;

- Passive income.

Let's consider each indicator.

1. Value is the sum of the value of current assets and cash. The value of each asset is calculated by the formula: current price of the asset * by its quantity.

If cash accounting is disabled in the portfolio, cash is not included in the value (Read More).

2. Invested - this indicator depends on the settings of cash accounting in the portfolio:

- All cash movements: all deposits minus all withdrawals;

- Current balance: sum of purchases of all current assets (total cost basis) + cash balance;

- Cash accounting disabled: sum of purchases of all current assets (total cost basis).

3. Total profit - this indicator also depends on the settings of cash accounting in the portfolio:

- All cash movements: portfolio value - invested + dividends that are credited to another account (does not affect cash balance);

- Current balance and cash accounting disabled: portfolio value - invested + dividends - taxes - commissions + sales profit.

4. Profit for the day (daily) - takes into account only the change in the price of assets for the last working day of the exchange, and is calculated as the quantity of current assets * by the change in price for the day. If the exchange is open today, it is necessary to take into account today, in other cases the last day when the exchange was open. Important: quotes are updated approximately every 30 minutes and each asset has its own “timer”, so they are updated at different times within 30 minutes.

5. IRR - this indicator is calculated by XIRR. More details can be found in this article.

6. Current holdings - shows the yield on current assets based on purchase transactions only (all other transactions are not taken into account). The XIRR formula is used for calculation, which uses purchase transactions of current assets with the final value of the total value of assets.

7. Passive income - is calculated as the sum of dividends for the next year from the 1st day of the current month divided by the current value of the portfolio without cash. Only regular payments are taken into account (special dividends are not considered).