One of the most important indicators for a dividend investor is the reliability of dividend payments, that is the company's ability to pay and increase its dividends. For the convenience of tracking this indicator, our service has implemented a "Dividend Rating" - it is based on 13 fundamental indicators of the company, and the lower it is, the less financially stable the company is and therefore, it’s more likely to reduce or cancel its dividends.

The company must at any time be able to repay urgently the following types of obligations: external obligations to be considered solvent, and short-term obligations to be considered liquid. Business activity indicators are also important. To determine these indicators, we use coefficients calculated on the basis of the company's financial statements. We make up the rating by adding these indicators with different weights.

- The main group of coefficients is directly related to dividend payments, which includes indicators of Payout (the amount of dividend payments relative to profit), dividend yield, etc., as well as the dynamics of these coefficients;

- The second group includes indicators related to the assets and debts of the company, including the debt coverage ratio due to revenue (liquidity), the amount of interest paid on loans, equity adequacy, etc.;

- In the third group there are coefficients related to the company's current activities, such as free cash flow and free cash reserve.;

- The fourth group of coefficients is related to the company's revenue and profit, as well as their dynamics and growth forecasts.

Each of the parameters included in the rating has its effect on the final value.

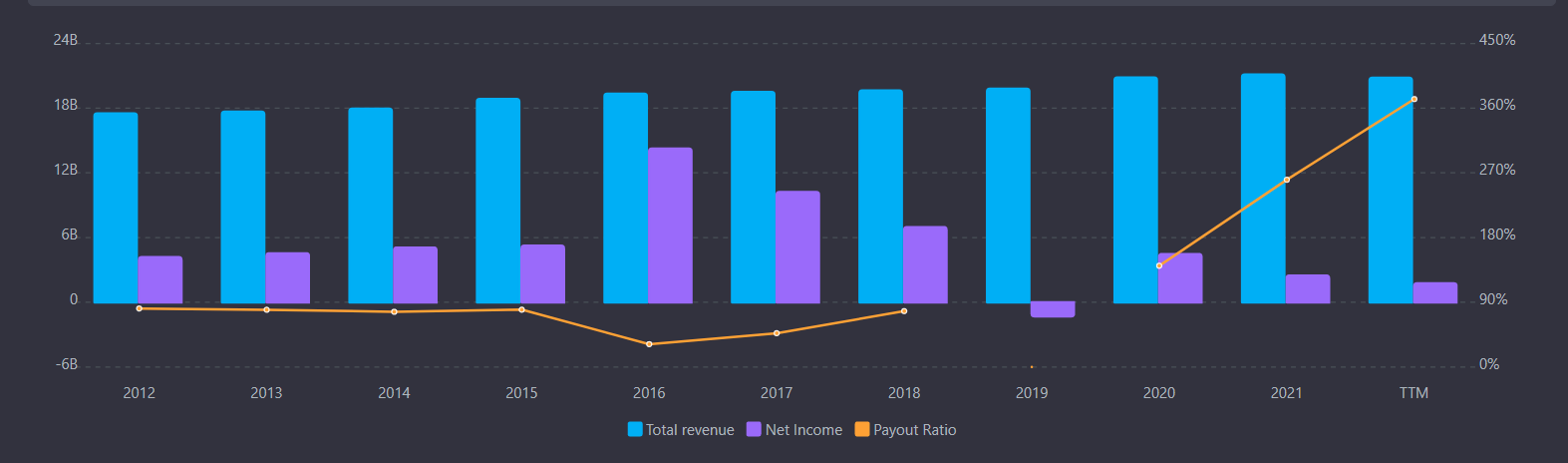

For example, if a company does not have a growing profit, a high Payout, but it increases dividends, then we can conclude that dividends are actually paid at the expense of borrowed funds, which cannot last for a long time.

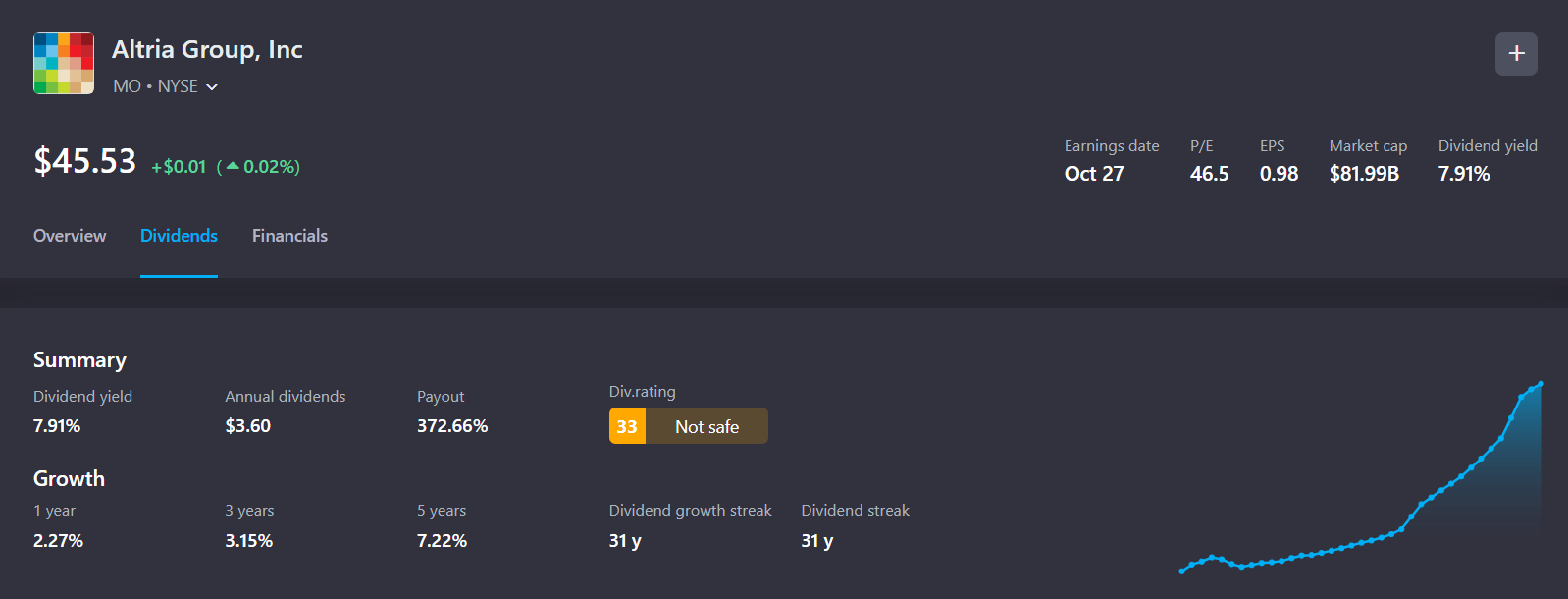

Such companies include the tobacco giant Altria Group (MO) - its revenue has not been growing in recent years, while its profits are falling. Despite this fact, the company continues to increase its dividends annually, as a result of which the Payout is growing. But the company still has enough money to maintain its current activities, so the value of the rating is Not safe, which indicates the need for increased attention to the company's future reports.

If a company has a high rate of profit growth, with a low Payout, few debts or they are cheap (low debt service costs), then the company is financially stable and can easily pay dividends and increase them.

An example of such a company is Apple. It has a large growing revenue, excellent profitability, due to which it has a lot of money. Debt servicing costs take up a small part of revenue, and the company is able to cover all debts within a year.